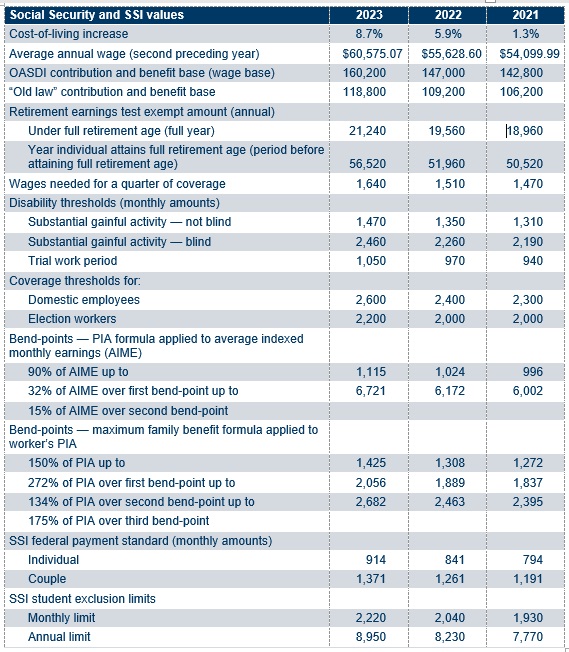

Social Security Withholding 2025 Max Lekaren - Maximum Social Security Tax 2025 Withholding Table Amil Maddie, The social security wage base limit is $160,200.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2022. 2025 Social Security Maximum Withholding Marna Shelagh, Social security tax withholding calculator.

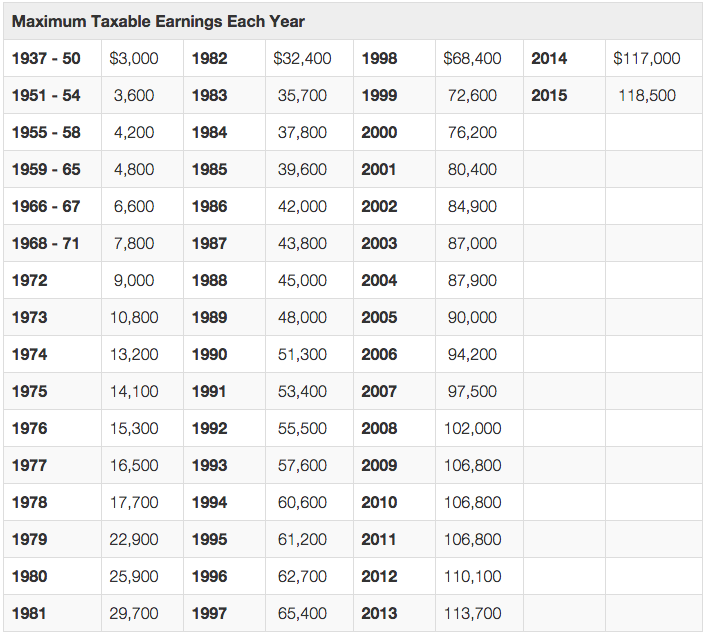

Maximum Social Security Tax 2025 Withholding Table Amil Maddie, The social security wage base limit is $160,200.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2022.

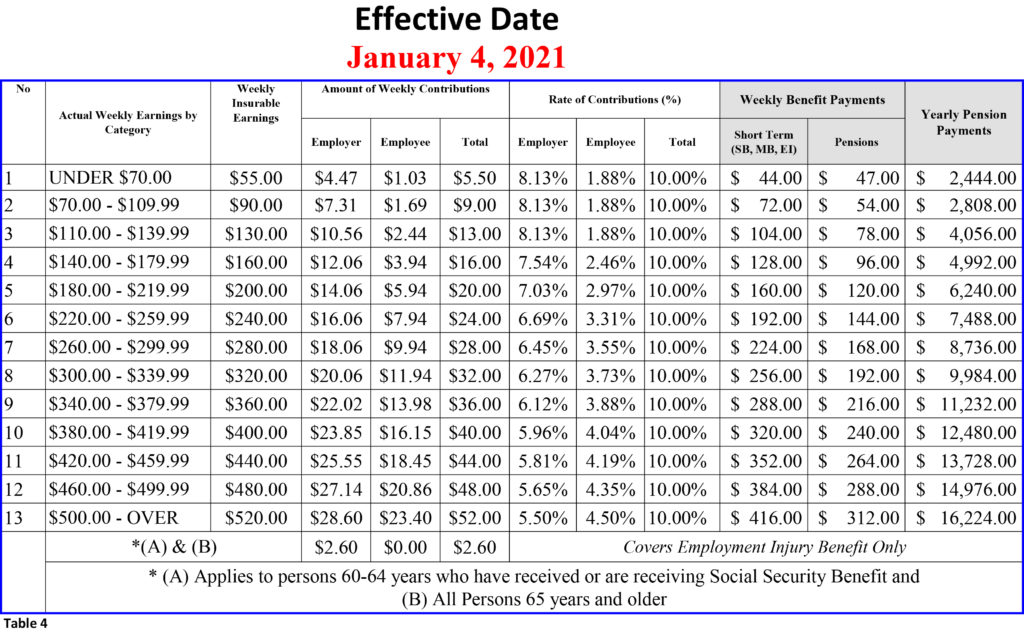

Maximum Social Security Tax Withholding 2025 Becca Lyndsay, We call this annual limit the contribution and benefit base.

Social Security Withholding 2025 Max Lekaren. The maximum social security employer contribution will. The federal government sets a limit on how much of your income is subject to the social security tax.

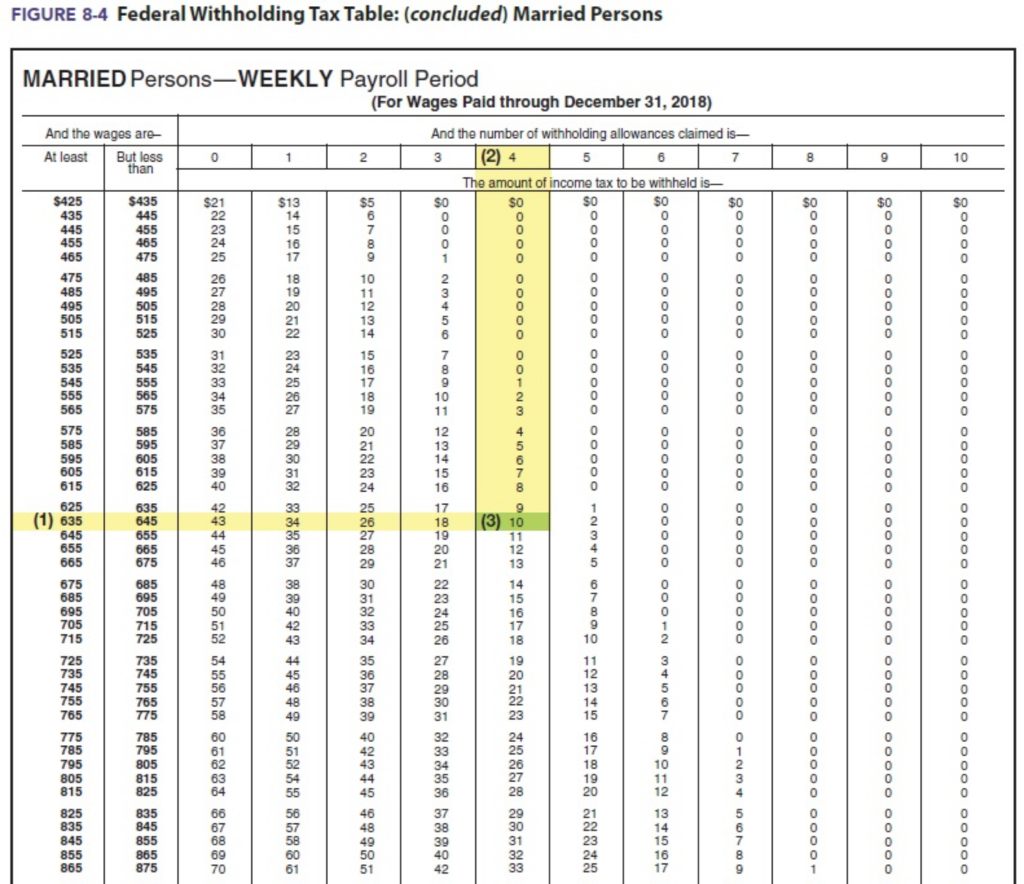

Social Security Tax Limit 2025 Withholding Form Ashlan Kathrine, The initial benefit amounts shown in the table below assume retirement in january of the stated year, with.

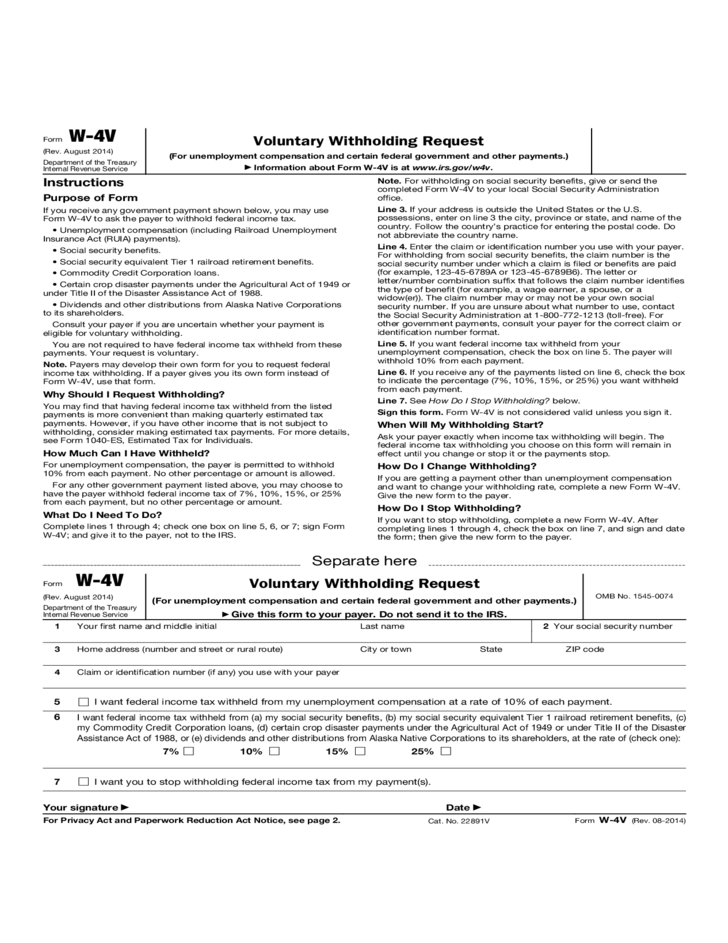

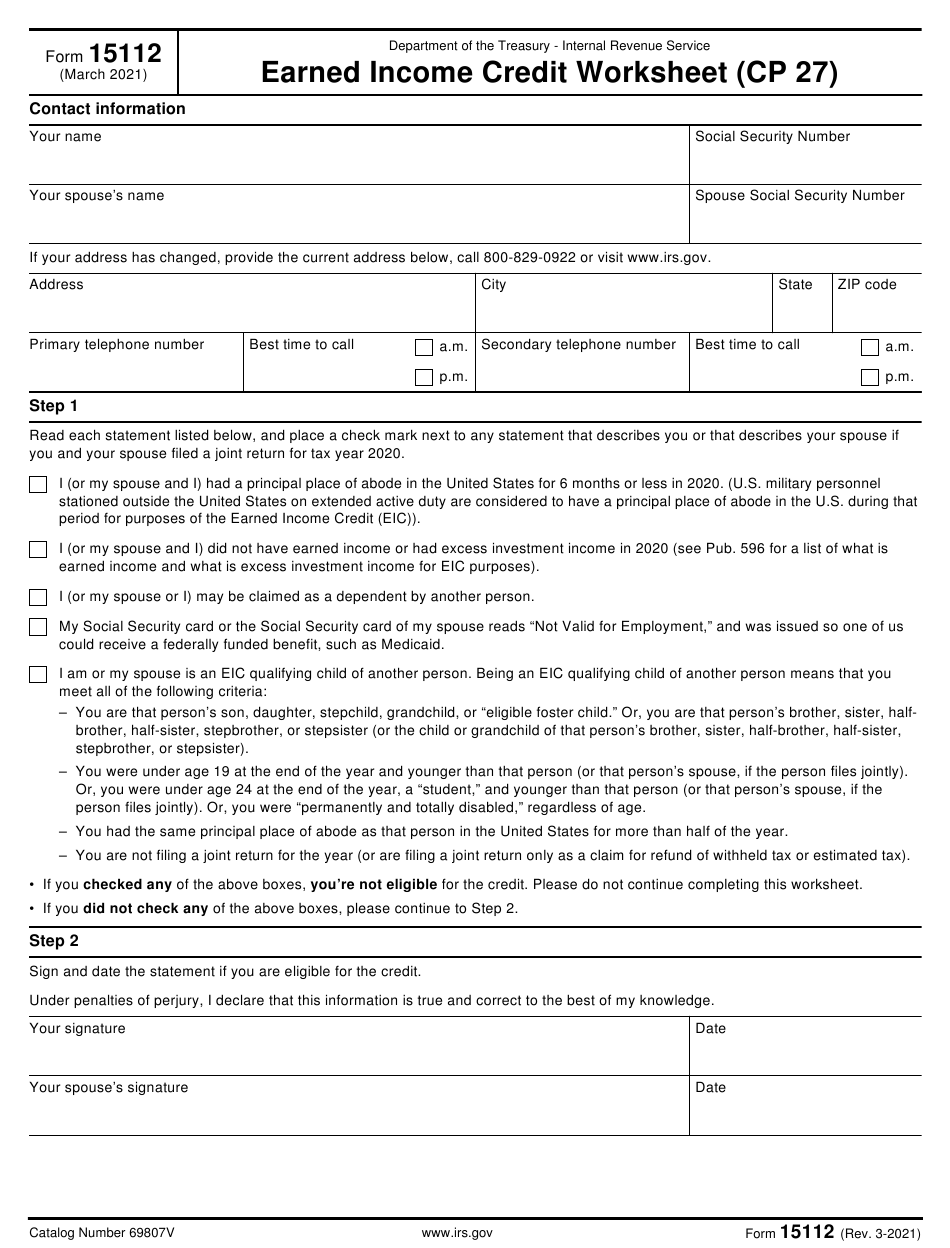

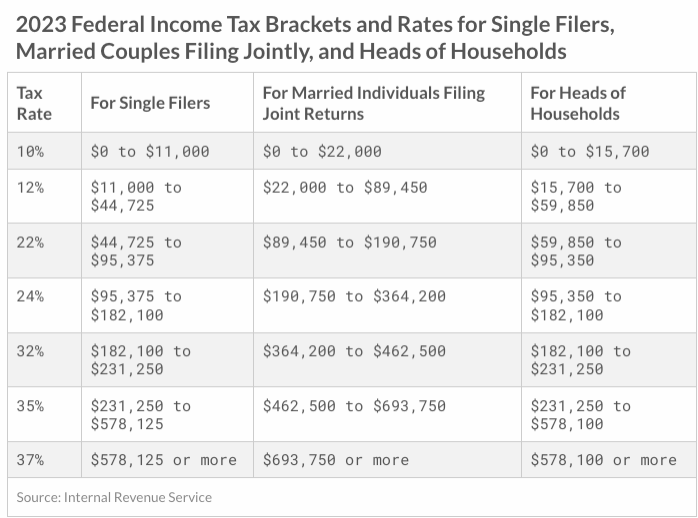

2025 Max Social Security Tax By Year Chart Conny Diannne, A retiree can use the tax withholding estimator to enter any pension income or social security benefits they or their spouse receive.

Maximum Social Security Tax 2025 Withholding Amount Marji Darleen, If you are working, there is a limit on the amount of your earnings that is taxed by social security.

2025 Maximum Social Security Withholding Jaine Lilllie, If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Social Security Tax Limit 2025 Withholding Tax Sonya Elianore, For 2025, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2025).

Maximum Social Security Tax 2025 Withholding Gretel Phaidra, The federal government sets a limit on how much of your income is subject to the social security tax.

In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. If you are already receiving benefits or if you want to change or stop your.

Social Security Max Withholding 2025 Tessa Gerianna, The social security tax limit refers to the maximum amount of earnings that are subject to social security tax.